NO SPEND September

As much as I love financial literacy, I am pretty awful at no spending challenges.

I really, really, REALLY want to complete them. But things always seem to pop up, don’t they?

I also really, really, REALLY love themes. So the theme of September was #NOSPENDSEPTEMBER in hopes that theme would motivate me to stay strong.

Things I was ALLOWED to spend money on, or NEEDS: Keep in mind, this is for OUR family. Everyone’s WANTS and NEEDS will be slightly different.

Bills (mortgage, utilities, subscriptions, loans and credit cards, savings and investments)

Necessities for the family (food, childcare, medical)

Gas for the car

Select personal care/entertainment events we had planned (and saved) for (if you don’t include joy in your budget, you will not do it!)

Pets/extended family

Business start up costs (more on this to come)

Things I was NOT ALLOWED to spend money on or WANTS:

Clothing/shoes (for myself) - I have PLENTY, but the children will keep growing. Matt will let me know when he needs things, he never spends on himself in this category

Home decor (mostly candles) - I have plenty of stock already…it’s just the matter of locating it

Junk food (in grocery pick ups) - here’s looking at you Ben and Jerry’s 🙁

Personal care (WITHIN REASON) massages/nails/waxes - it’s troll season! Also those are a luxury I cannot afford right now

I broke my no spend challenge this month fairly quickly.

But in my defense, I did run my purchase by my husband, Matt. He is my accountability partner and the primary income earner at the moment.

We agreed plug-in wax warmers were a NEED because:

1) there are many smells in this household

2) candles are TOO EXPENSIVE

3) wax melts are more cost effective (6 melts for $1)

4) they don’t have to be on constantly to make an impact

5) Double as night lights!

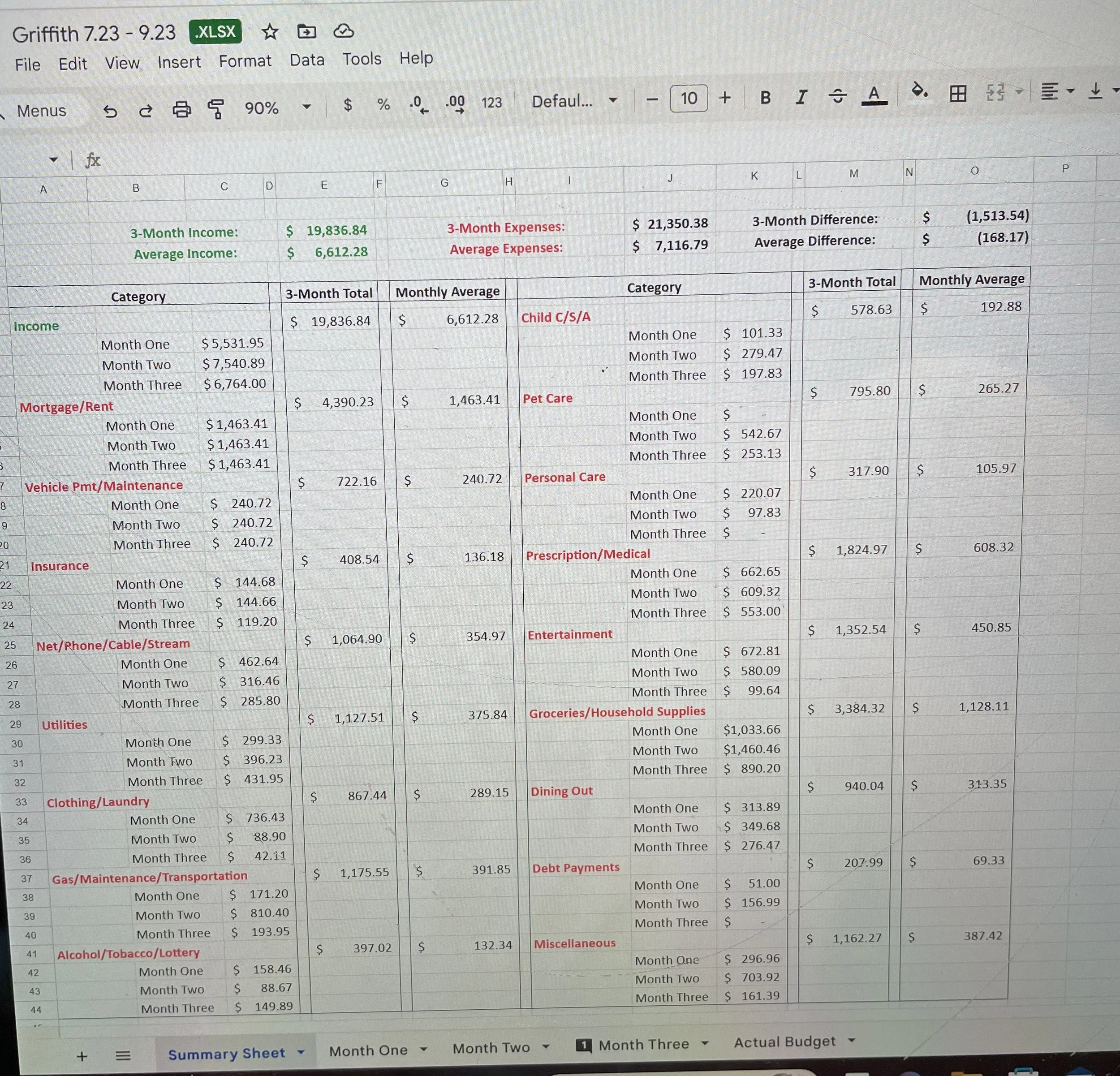

Despite the fact that I did spend on WANTS, this month we were below budget in many of our problem areas:

Alcohol/Entertainment: DECREASED by $573.17

Dining/eating out: DECREASED by $73.21

Groceries/Household: DECREASED by $570.26

Miscellaneous: DECREASED by $542.53

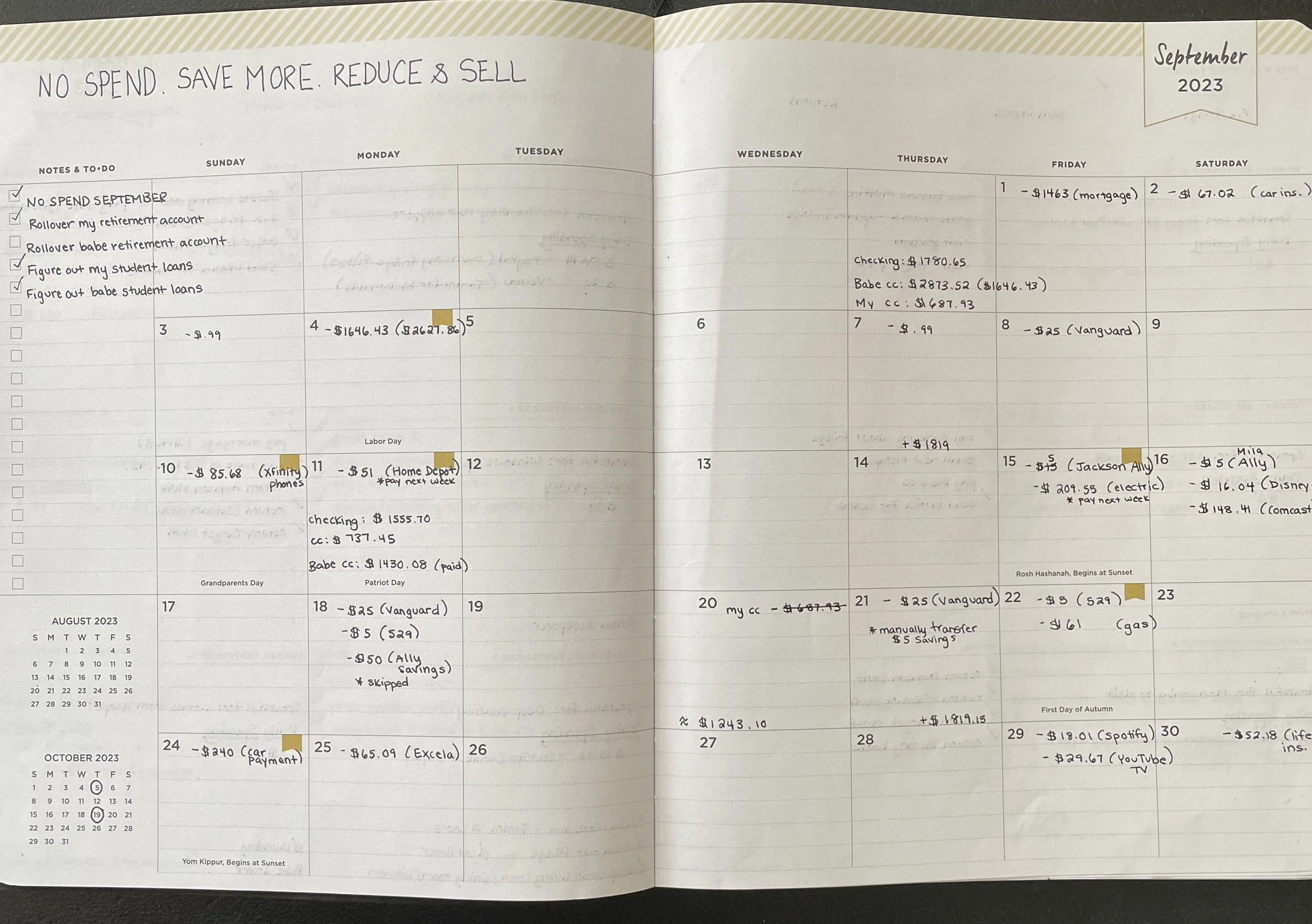

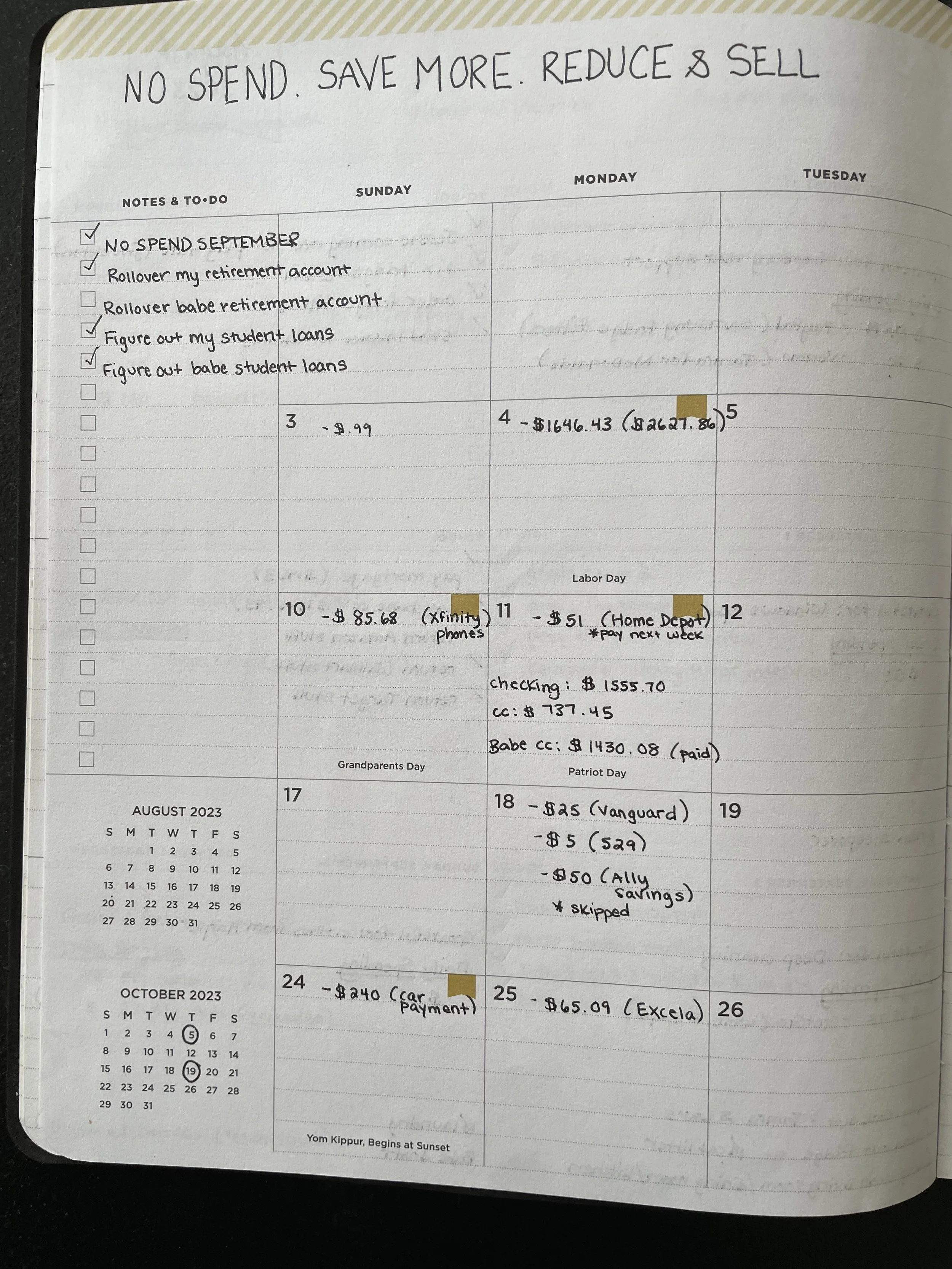

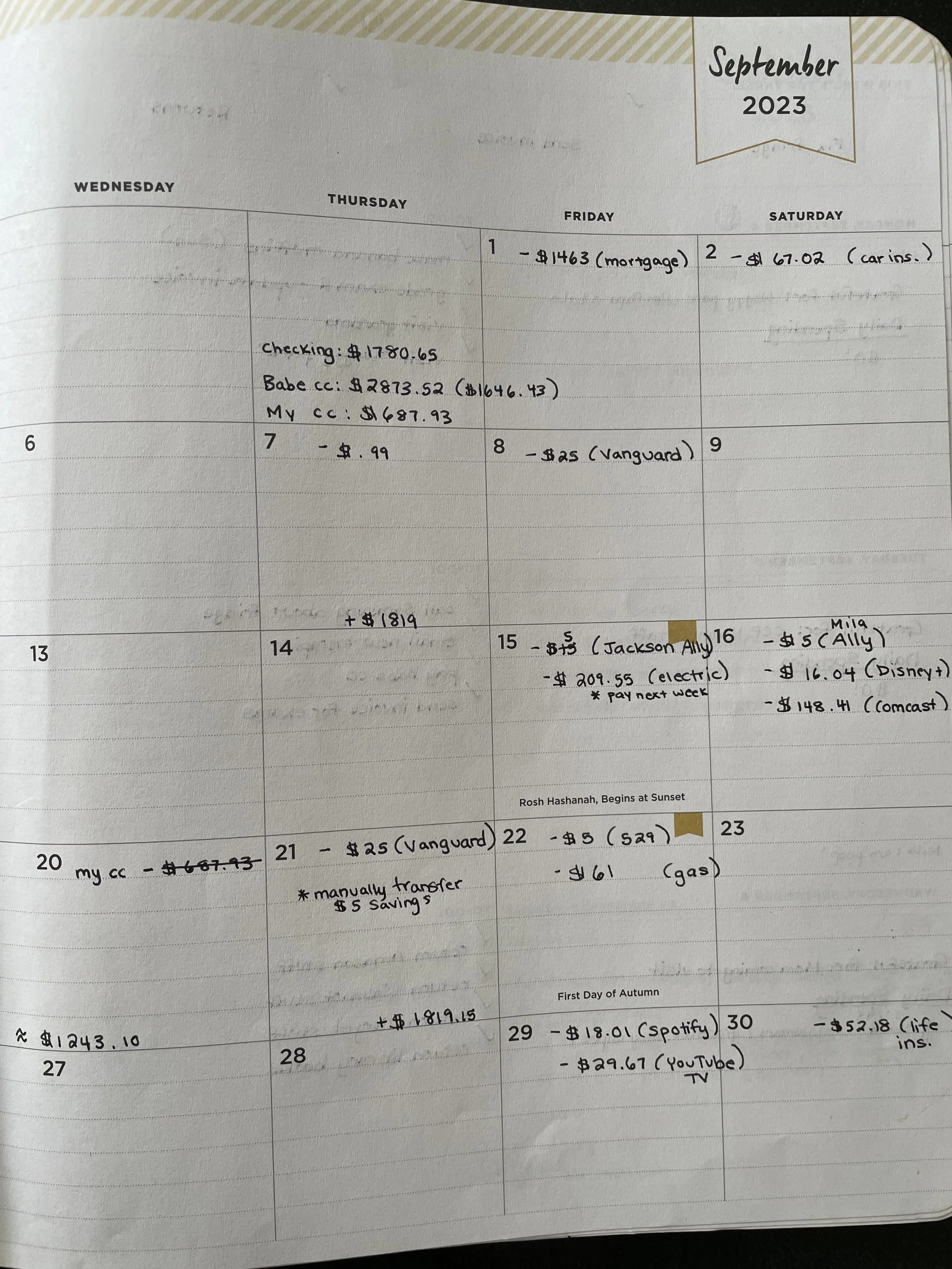

I made a calendar for the month of September so I could make sure we could pay everything on time, here is what it looks like:

Things the calendar DOES NOT include, but you should think about on a weekly basis:

Food (NEEDED food for survival - not take out, not meals out)

Gas (transportation to job, school, store, childcare, etc…)

Child care (diapers, wipes, baby food, formula, ALL THE MILK)

Health/Personal (prescriptions, therapy, health bills, medical marijuana)

I put a +$ for income and -$ for expenses. Totals each week often change, but looking at the balance frequently prevents surprises.

I’m a visual person so seeing the month at a glance keeps my spending in check and gives me an idea of how much I’ll have available each week after bills.

I also use my bank statement to complete this 3 month tracking Google sheet a co-worker of mine created. It forces me to look at my ACTUAL spending versus the budget I think is working.

The sheet has a summary page that compares three months of spending and gives you an average to expect based off those three months.

These are the final numbers for September. We have some work to do still, but overall did much better in month three.

Remember, no one is perfect with money. Be kind to yourself, and don’t be afraid to start again!