JUMP Back In July

I wish I had better updates. I am still grief shopping (stress shopping, anxiety shopping, emotional shopping…whatever we want to call it). And to top it off, Matt and I got sick just in time for our five year wedding anniversary!

I married this tasty snack of a babe July 27, 2019 <3

July is usually for vacations and summer parties, however we could not afford to go on vacation this year. Which is totally fine.

But I shouldn’t be shopping for ANYTHING extra. Not right now. Not if we couldn’t go on vacation right?!

July 25, 2014 <3

Summer is just always extra. Looking at our spending patterns over the years I’ve noticed we typically have higher expenses when it gets warm: bills (AC) entertainment (drinking, going out to eat, concerts) travel (vacations), gift giving (baby/bridal showers, weddings, birthdays, graduations).

July 16, 2015 <3

It’s so easy to get carried away, and for some reason, not pay as much attention to my finances when I’m in “vacation mode”. Side note: I looked at my planners the weeks I went on vacation the past few years and noticed NO PLANS, NO EXPENSES AND NO ACCURATE RECORDS WHATSOEVER.

But “vacation mode” can really hurt our finances.

So I decided to start practicing again. Maybe I could revisit some of my old trusty financial literacy stuff? Maybe, I could JUMP BACK IN?

July 31, 2016 <3

I have the resources (all my old teaching and counseling materials).

I have the knowledge (I taught financial literacy for four years and then became a certified credit counselor for four more).

I have the willpower (I need to DO SOMETHING to snap myself out of this impulse spending).

August 10, 2017 <3

I have started implementing one of my old savings tricks: ask yourself before each purchase: “Do I want this more than (insert savings goal)?”

Do I want this more than a POOL?

Do I want this more than a VACATION?

Do I want this more than PAYING DOWN DEBT (probably yes, but I have to remind myself sometimes, lol)

Do I want this more than FINANCIAL PEACE knowing I added to our emergency fund?

Do I want to add more to my life?

Do I have a place for this?

Would I take it if I moved?

July 27, 2018 <3

July 7, 2020 <3

July 30, 2021 <3

July 4, 2022 <3

While this exercise has helped me, my students, and my clients in the past, IT WASN’T STOPPING ME.

I think it’s time to JUMP back in to… THE CALENDAR.

The CALENDAR is literally a printable monthly calendar sheet (preferably paper, preferably free). I used this freebie.

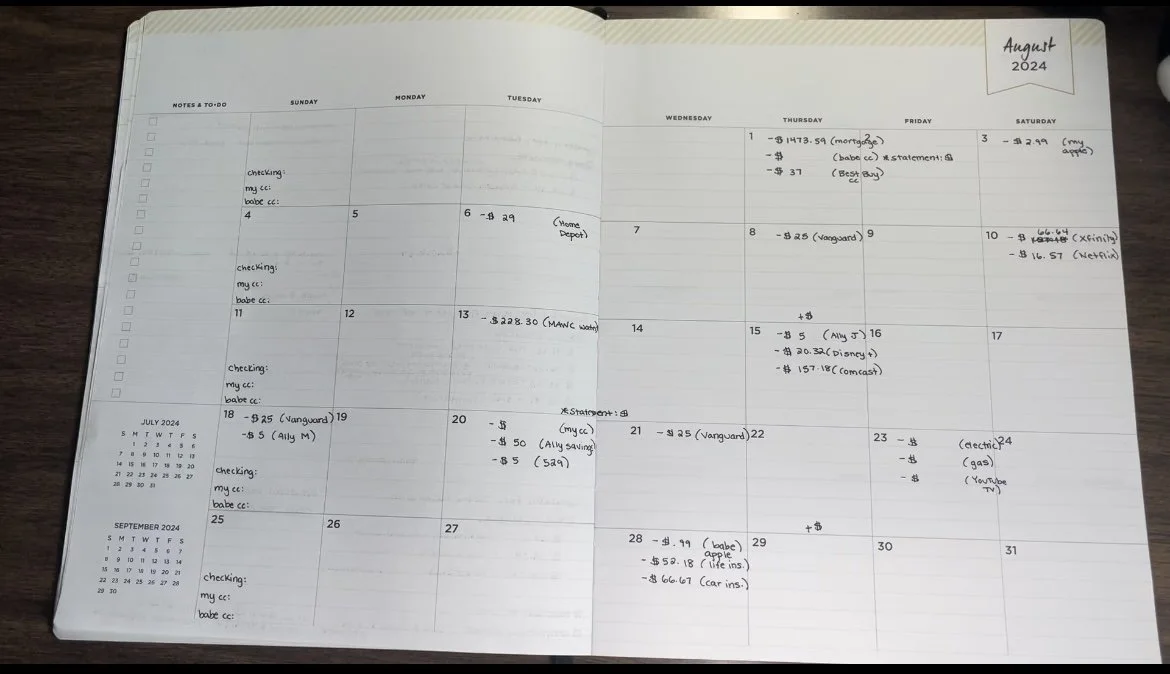

My client would come in with their bank statements from the past 3 months (you want to have at least a few months to work with) OR pull up your bank app on your phone and look at the activity.

We start with the first of the month and work our way through:

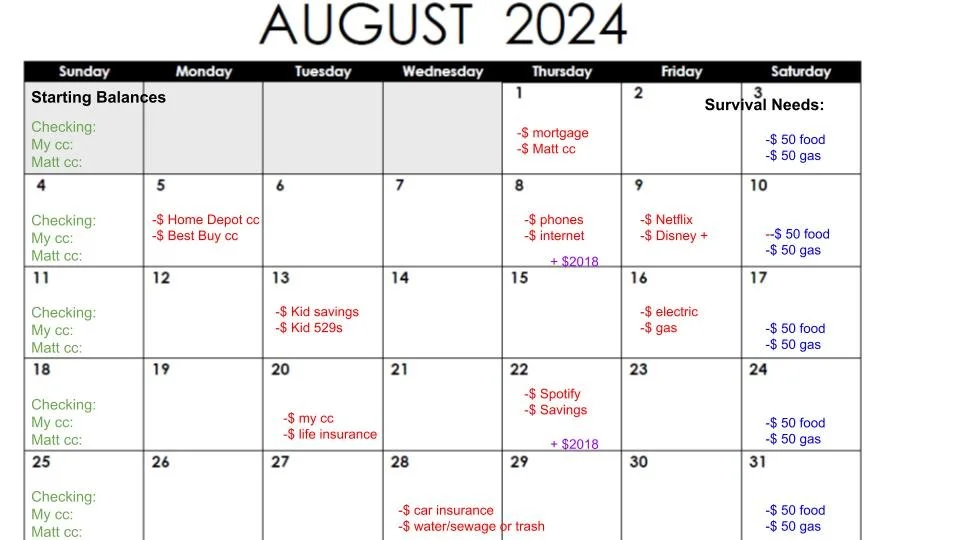

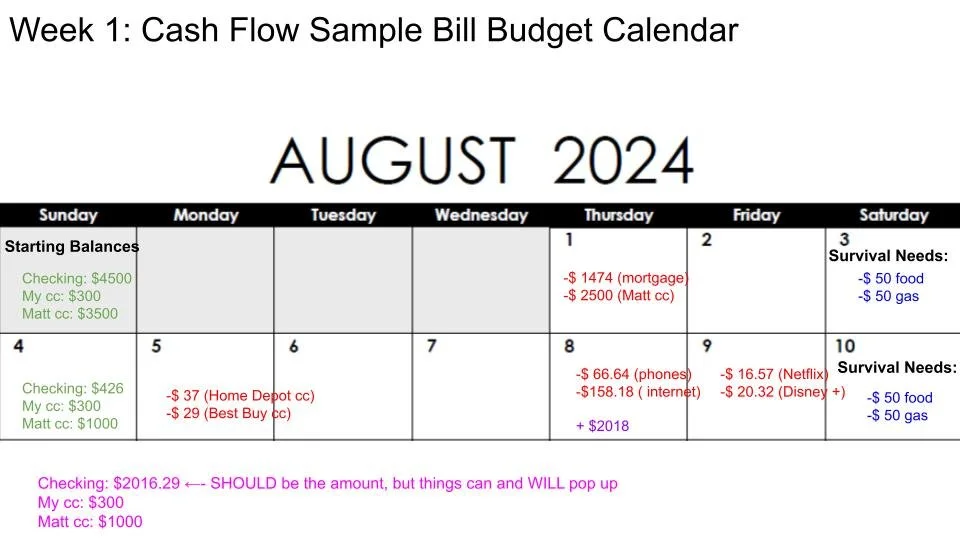

Income: when do you get paid? What is the amount that hits your bank account? NET (AFTER TAXES) I used a “+ $” for income (direct deposit, benefits, cash app deposits, etc…)

Expenses:

start with the bills that are fixed and do not change

bills based on usage can just be written on the due date and round up in your estimates (ex: electric comes out of the second pay/14th or later and is AT LEAST $100)

I used a “ - $” for the expenses

Survival:

Subtract an amount for food/household each week (we used $50 as a min)

Subtract an amount for gas/transportation/travel (we used $50 as a min)

Subtract an amount for children/pets/miscellaneous (we used $50 as a min)

DO THE MATH. As someone who struggled with math, but has grown to love and appreciate it, this is an important step. Thank you Mister Marx! #MisterMarx

You want to go week by week, add and subtract the numbers. Also known as cash flow, this allows you to see what you have to work with each week, and better anticipate surprises.

The beauty of the calendar is that it is VISUAL. It allows you to see what you are working with and what needs to be prioritized.

Did clients always follow the calendar? No. But they could show me exactly where things went off, or were able to make preparations to avoid an overdraft based on sitting down to LOOK at where their money was going.

August is almost ready to go!

Had I done a money calendar this July (or at least a complete one), I may have fared better. Just because we have a plan, doesn’t mean we will follow it. What is important is that I had a general idea of when I needed to have money in the account, and I accomplished that.

July is almost over, and I have failed another month of not impulse shopping. However I will revisit my money wins and money goals…because why not?

Completely #secondhand outfit and one of my FAVORITE necktie belts.

Money Wins:

Purchased primarily second hand - my annual TJ Maxx toiletry shopping got the best of me this year, but mostly it was thrifting and Poshmark, and it NEEDS TO STOP.

Sold and made more belts - now I just need to list, list, list.

Rebuilt emergency fund - thank you mom and dad <3

Was able to donate more than my original goal <3

Money Goals:

Once again: NO NEW CLOTHES, SHOES OR CRAFTING SUPPLIES. It must happen in August. It MUST

See number one. It’s my only goal.

Ok fine, sell some sh** 🙂

Ok sorry, donate at least $20 this month, if not more.

This orange and blue flower tie was half off at my thrift store, and looks ADORABLE with this orange and blue outfit…also completely #secondhand

Outfits I’ve Been Wearing:

Dress: thrifted, no tag

Tulle top: Thrifted, no tag Pink midi skirt: Poshmark (a new day) Visor hat: Poshmark Sunglasses: Fashion Nova

Orange dress: Poshmark (Future Collective for Target) Multicolor striped button down: top of 2 piece set from Fashion Nova Fanny Pack & earrings: thrifted (fanny pack is Stoney Clover for Target) Sunglasses: Dollar Tree

Watermelon top: Poshmark (Nasty Gal) Red midi skirt: thrifted (Koret)

Watermelon top as a tube top and Mila in Peaches <3

Cherry tube top/skirt: Poshmark (Target kids’ brand) Red gingham skort, pink/red fanny pack: Poshmark Sunglasses: Fashion Nova

I was doing a whole fruit theme: Watermelon, Cherry, Orange…you’ll get the idea :)

ORANGE you glad to see these outfits? lol

Orange shorts and earrings: TJ Maxx Orange top and bra: thrifted Orange bag, sunglasses, necklace & platforms: Poshmark

Orange and lemon romper: Poshmark (Wild Fable Target) Yellow crossbody: thrifted Yellow sunglasses: Dollar Tree

Just a couple citrusy ladies

Mila’s dress says: Daddy’s main squeeze. I’m in a lemon print tube top 2 piece skirt set from Poshmark. White sandals are thrifted but Sam & Libby

One of my favorite and most complimented outfits this month! Amazing yellow floral top: vintage at my thrift store - no label Lime green shorts: Poshmark (Shein)

Blue/green swirl skirt: Poshmark (Wild Fable) Lime green halter & purse, sandals: thrifted Sunglasses & earrings: Fashion Nova

Lime green top and skirt set: Poshmark (H&M) Pink nikes: Poshmark Pink & yellow fanny pack: thrifted Sunglasses: Fashion Nova Earrings: TJMaxx

Scarf, sunglasses, necklace: Poshmark Skirt and sandals: thrifted

Navy bralette: thrifed Shorts: Poshmark

Pink ruffle floral top and gingham shorts thrifted from Goodwill :)

Lurve these together

Whole outfit thrifted - except my Dollar Tree sunglasses

Crochet dress: thrifted (Target Wild Fable) Babe visor, fanny pack: Poshmark

Red dress: Shein Floral wrap skirt & pink gem necklace: thrifted

Teal tube top bodysuit & plaid shorts: THRIFTED (shorts are Koret)

Pink tank & coral floral skirt: thrifted (side note: the skirt was inside out somehow when I originally bought it, but I LOVE IT with the silky side). Yellow slides: Poshmark (a new day Target)

Flower earrings: TJMaxx Flower necklace: Poshmark

Skirt: two men’s button down shirts (tutorial here) or here. Necktie belt: for sale on Poshmark . Denim corset top, K necklace, cat necklace: Poshmark

Red floral midi skirt & black knit crop top: thrifted

Things I’ve Been Crafting:

Scarf purse for Monica’s trip to Italy <3

Reversible, handle = body chain (lol)

Customized sweatshirts for nephew’s birthdays. Letters made from Jackson’s old baby onesies <3

Cream necktie belt

Owl necktie belt

Cotton Candy necktie belt

Orange & blue groovy necktie belt

Now I just need to get things lissteeddd….

What did you JUMP back into this July?